Gift Vouchers and Cards are Actionable Claims, GST Applicable on the Date of Redemption u/s 12(4)(b) of CGST Act: Madras HC

$ 15.50 · 4.9 (717) · In stock

A Single Bench of the Madras High Court has recently held that gift vouchers and gift cards are actionable claims and Goods and Services Tax

Is Trading In Vouchers Taxable In India under GST?

CGST, Taxscan

GST HST Rebate Claims - Jeremy Scott Tax Law

Madras high court clarifies on gift voucher GST - Times of India

Request for GST/HST retroactive payments – Personal and Corporate Tax Consulting & Accounting Services in Canada

Taxscan on LinkedIn: Depreciation Allowable on Goodwill u/s 32(1

Wouter Pors on LinkedIn: Here is the picture of the full UPC Court of Appeal after the oath taking…

No GST Applicable On Supply Of Vouchers: Karnataka High Court

Headlines, Taxscan

GST Assessment Order cannot be passed by investigating officer: Madras HC

GST Notes-CA Inter-May 23 1 Lyst8910 PDF, PDF, Taxes

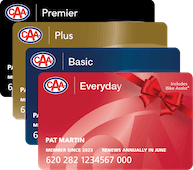

Recipient Activation - CAA South Central Ontario