Qualified Vs Non-Qualified ESPPs

$ 12.50 · 4.5 (327) · In stock

Qualified vs Non-qualified ESPPs. We take you through an explanation of what they are, their differences and which one is best for you as an employee.

This post explains the two main types of employee stock purchase plans (ESPPs), detailing the differences between them and their tax implications.

Introduction To Espps And Qualified Dispositions - FasterCapital

ESPPs: A Long Term Investment Strategy for Financial Growth - FasterCapital

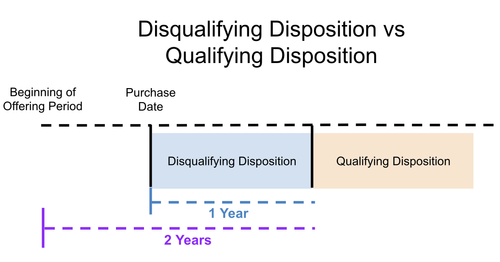

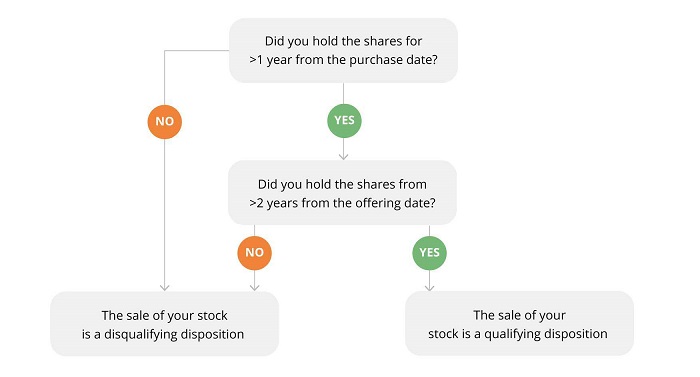

ESPP Disqualifying Dispositions Explained — EquityFTW

Introduction To Espps And Qualified Dispositions - FasterCapital

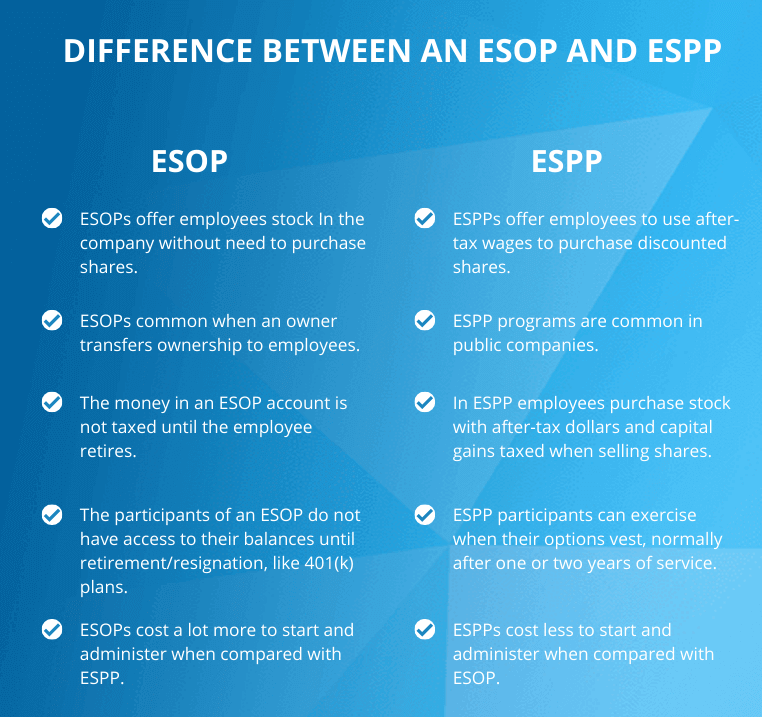

Employee Stock Option Plan (ESOP) vs Employee Stock Purchase Plan (ESPP)

Tax Planning with ESPPs: Minimizing Your Tax Burden - FasterCapital

ESPPs: A Long Term Investment Strategy for Financial Growth - FasterCapital

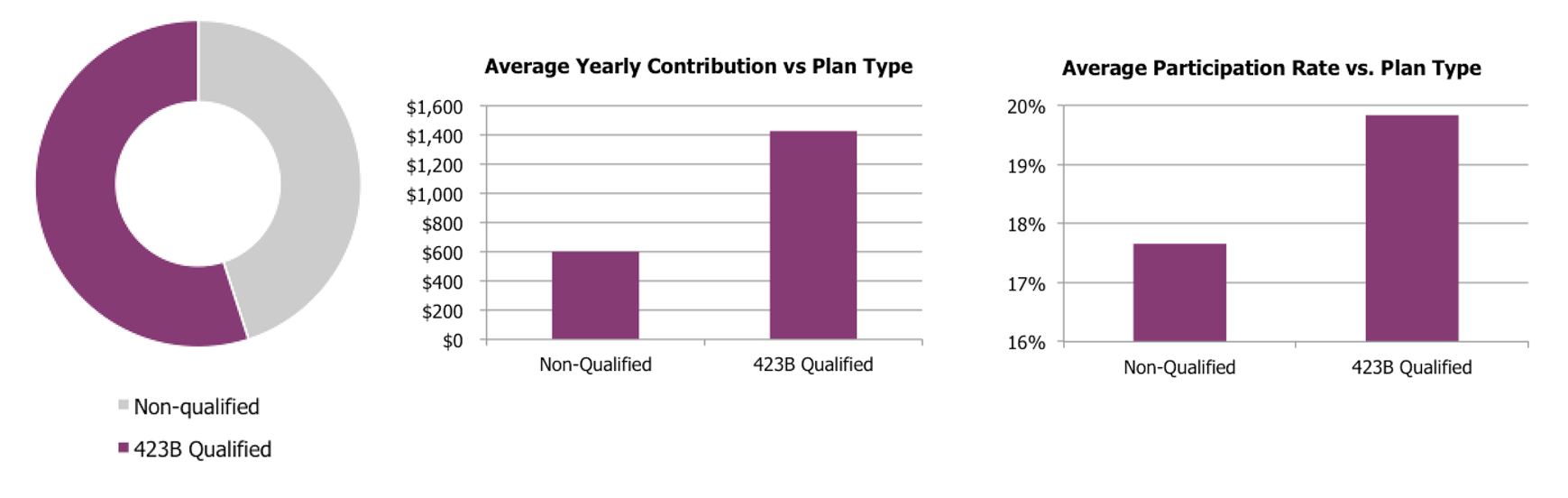

2018 Employee Stock Purchase Plans Survey

Offering an Employee Stock Purchase Plan Your Participants Will Value

Nonqualified ESPP Taxes: 5 Things You Need To Know

stock purchase - FasterCapital

Employee stock purchase plans (ESPPs) and taxation: An overview of the rules and regulations

A Guide to Your Employee Stock Purchase Plan

Stock Options Made Simple: What Do You Need To Know About ESPPs? — The Dala Group

Qualified Vs Non-Qualified ESPPs