Tie breaker Rule for an individual in International Taxation

$ 29.99 · 4.9 (653) · In stock

Article 4 deals with the provision, where an individual becomes a tax resident of the Country of Source as well as Country of Residence . I.

Article 4 - Residence - Tie Breaker Rule for individual, Companies

Article 4 - Residence - Tie Breaker Rule for individual, Companies

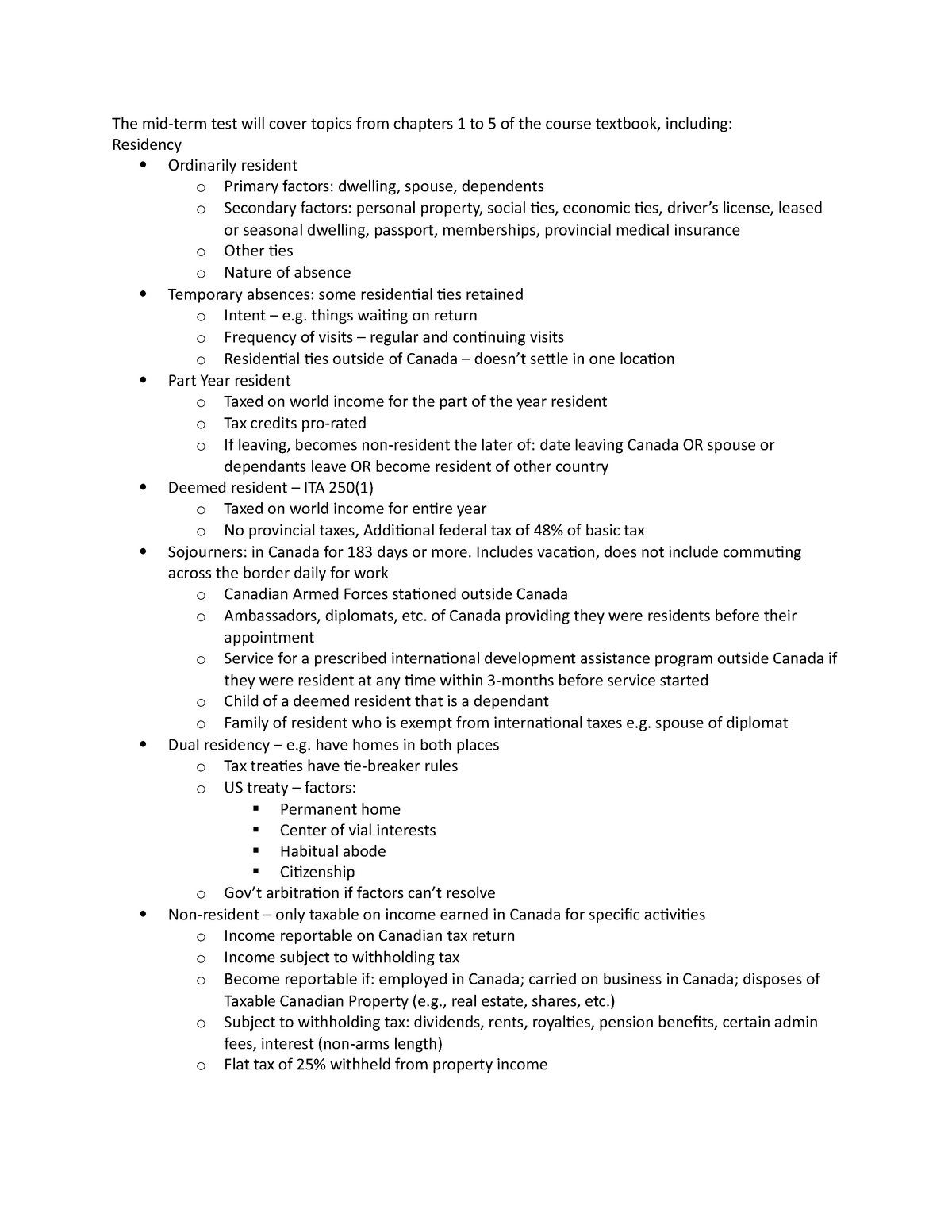

ACC540 Midterm prep - Notes on chapters 1-5 - The mid-term test will cover topics from chapters 1 to - Studocu

CA Arinjay Jain on LinkedIn: #uaecorporatetax #tax #uae

CA Arinjay Jain on LinkedIn: #uaecorporatetax #uaetax

Tax Treaty: Understanding Double Taxation and Expatriation - FasterCapital

Managing the Tax Residency of Foreign Affiliates in the Face of the COVID-19 Restrictions

Structuring Foreign Investments into India Series - Part 1 - The

CA Arinjay Jain on LinkedIn: #india #taxnews #tds #taxnews