What is the journal entry to record a foreign exchange transaction gain? - Universal CPA Review

$ 8.99 · 4.5 (122) · In stock

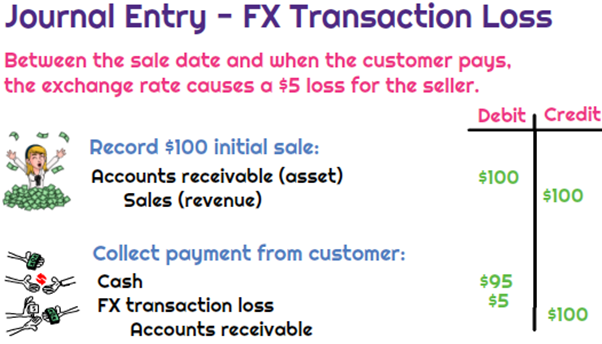

A foreign exchange transaction gain occurs when the transaction currency is different than the reporting currency for the company. On the initial transaction date, they would record the $100 sale with a debit to accounts receivable and a credit to revenue. However, 30 days later when the customer goes to pay using the current exchange

4.12 Equity transactions

Challenges and Next Steps in Working with International Clients

I only need help with B, D, and E. I will post the

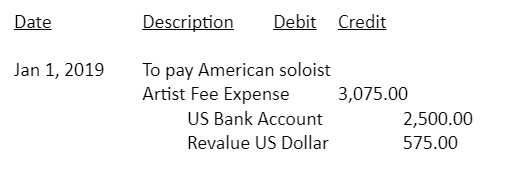

How do I record a US$ or other foreign currency transaction

Document

Marty Zigman on Learn How To Craft Better NetSuite Financial

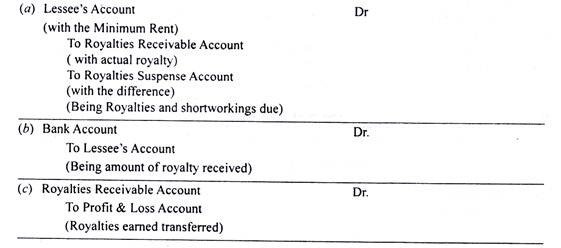

Accounting records for Royalty in the Books of Landlord – intactone

Property Management Accounting Basics: Definitive Guide

What is the journal entry to record a foreign exchange transaction

Evaluate your job offer AACSB Career Connection

Hedges of Unrecognized Foreign Currency–Denominated Firm

Accounting For Cryptocurrencies: All You Wanted to Know Know About

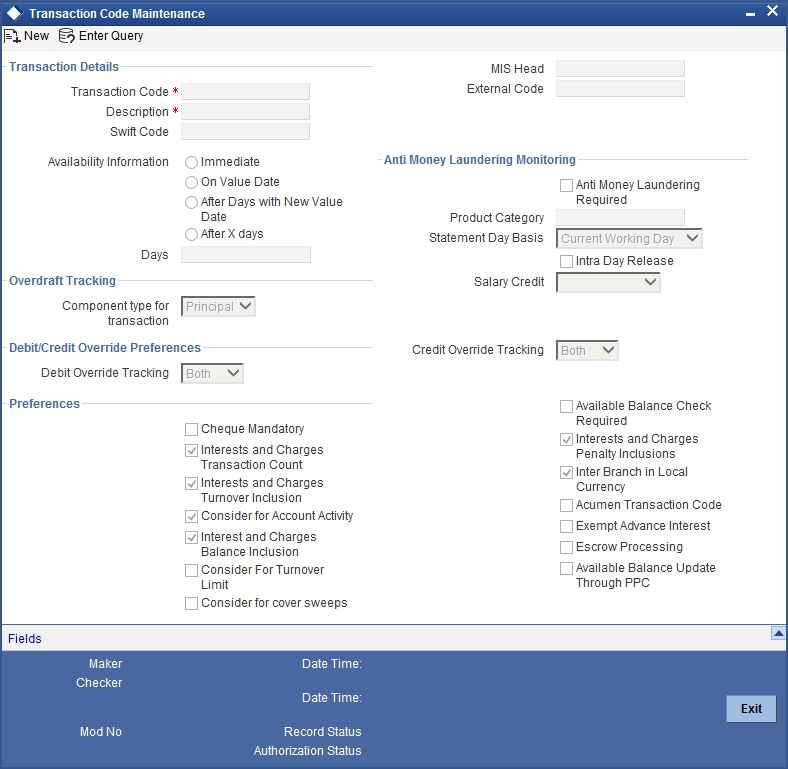

21. Transaction Code

Acc 303 week 5 midterm exam strayer university new by

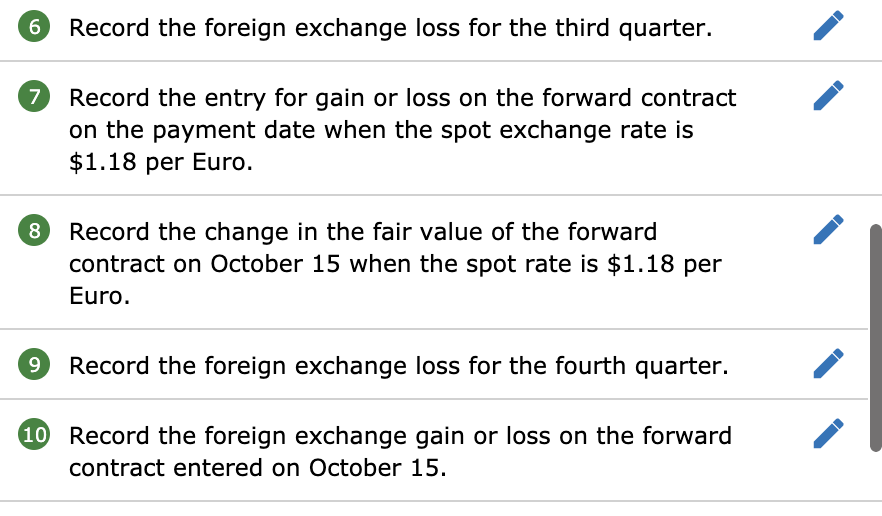

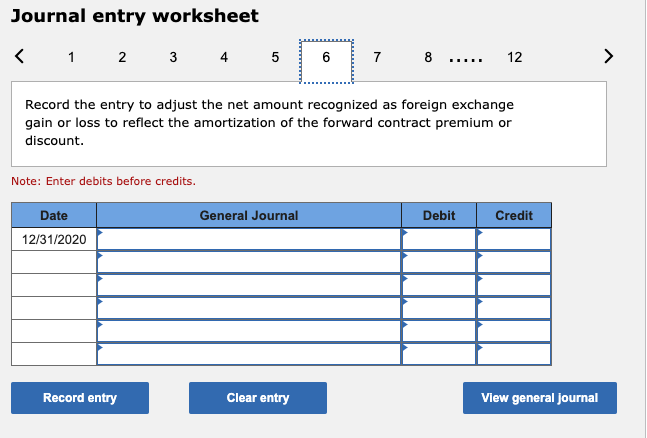

Solved Journal entry worksheet Record the foreign exchange