Some banks with underwater bonds may weigh taking their lumps

$ 23.00 · 5 (775) · In stock

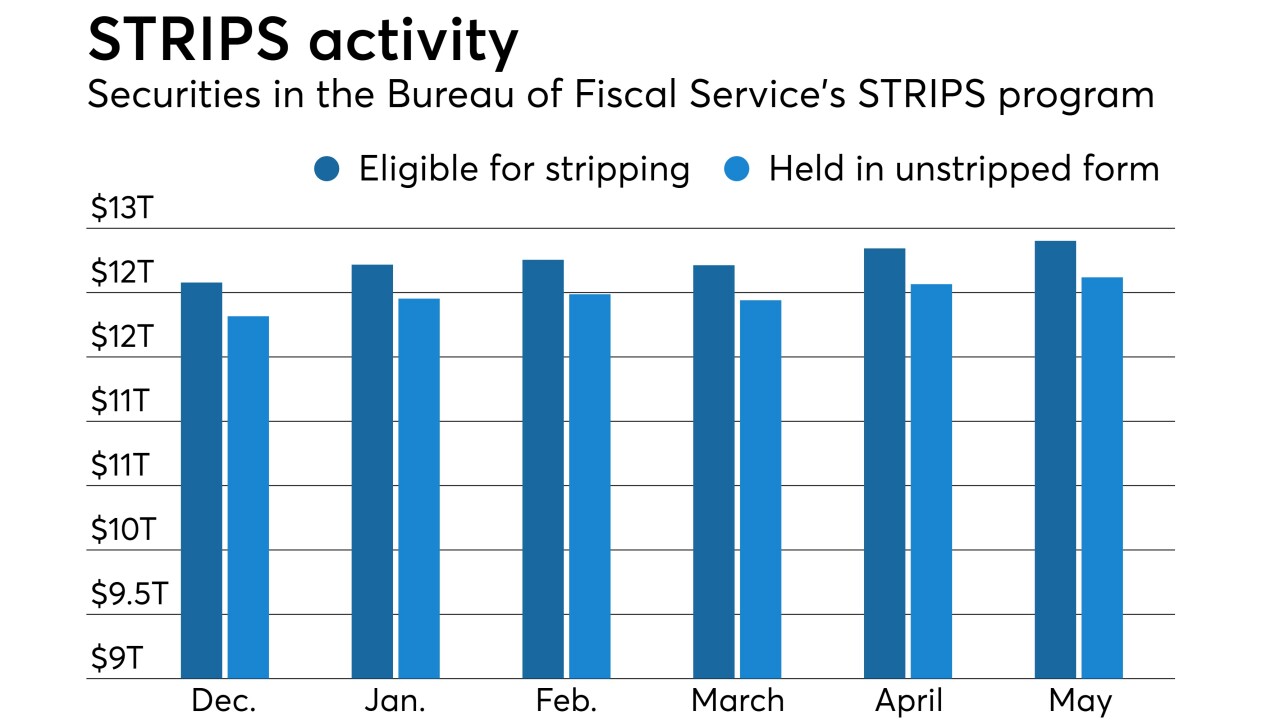

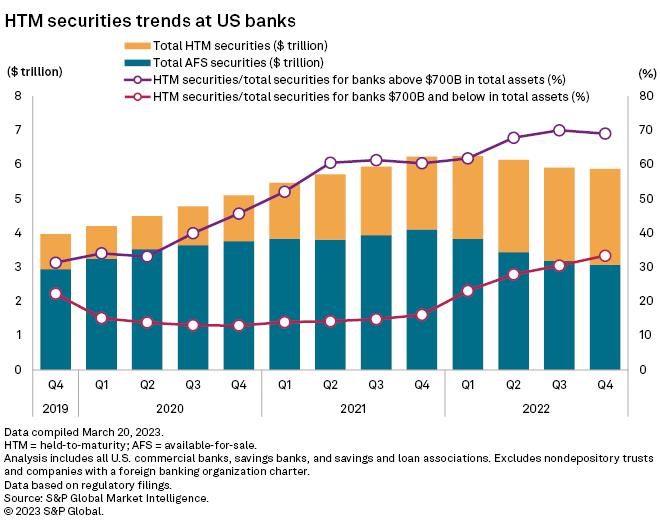

The decrease in long-term interest rates this year has helped banks' bond portfolios recover a bit. Some of them may consider restructuring their securities portfolios in the short run, and longer-term changes are also possible as the fallout from last month's crisis continues.

The decrease in long-term interest rates this year has helped banks' bond portfolios recover a bit. Some of them may consider restructuring their securities portfolios in the short run, and longer-term changes are also possible as the fallout from last month's crisis continues.

Has there been any blue whale - human interaction? We see a lot of

Securities Bond Buyer

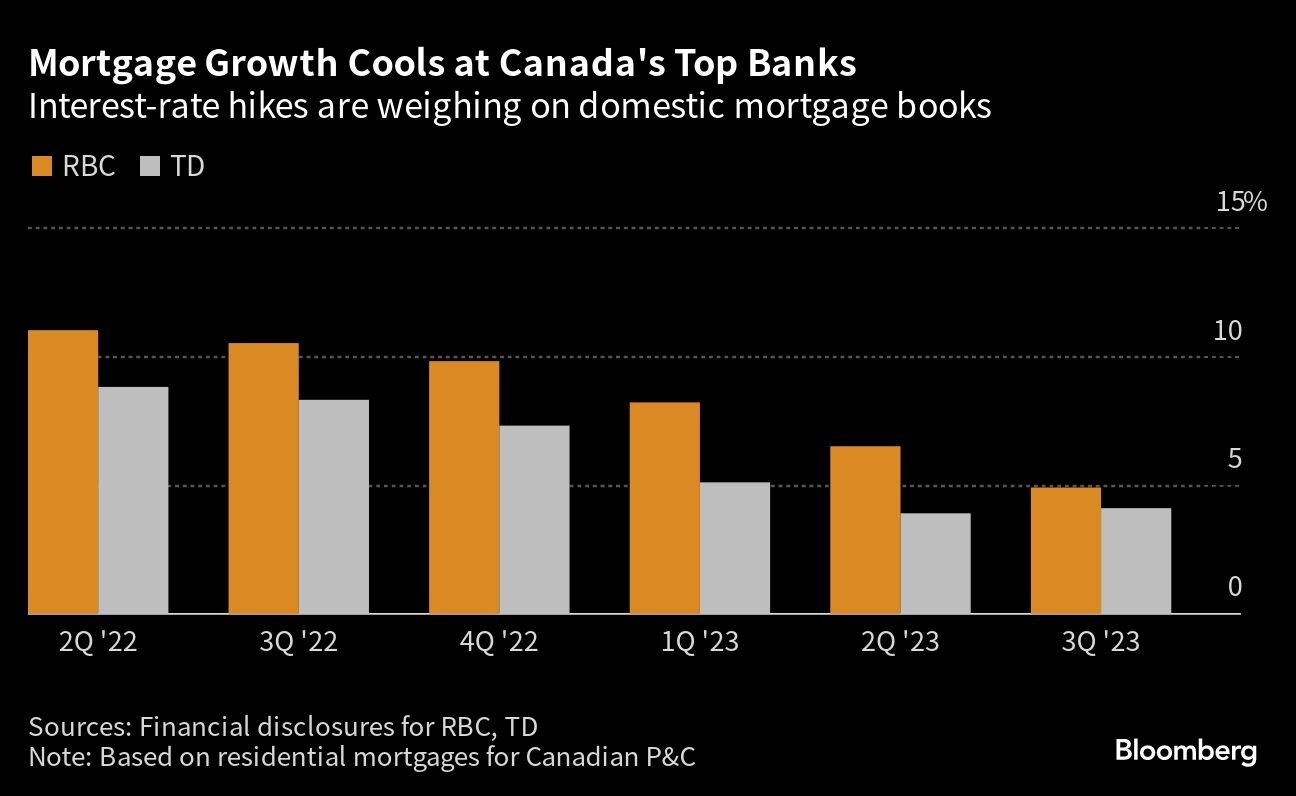

Homeowner stress bursts into view in Canada banks' mortgage data

Divers for the Environment March 2024 by Divers for the

Joan Feldbaum-Vidra on LinkedIn: I'm happy to share that I'm starting a new position as Senior Managing…

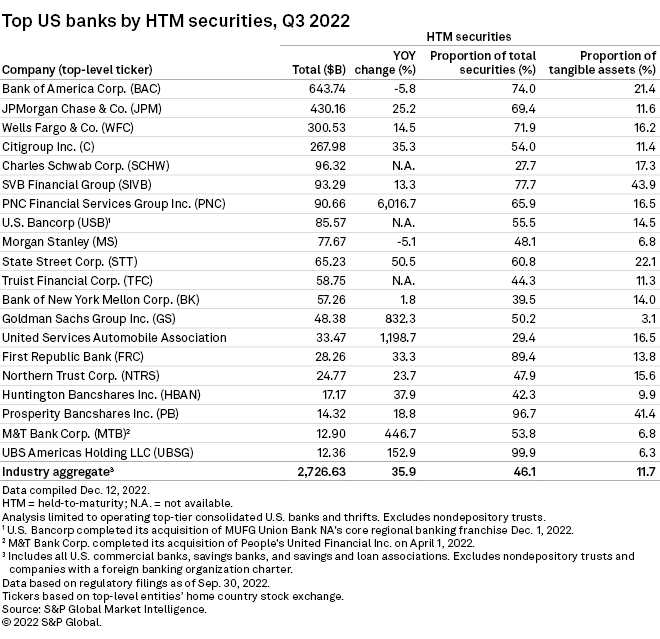

Bank investing faces scrutiny due to underwater bonds, liquidity

“Underwater bond positions . . . have to be addressed”

A Hole at the Bottom of the Sea: The Race to Kill the

Want to feel special? Stores and restaurants with paid memberships

Joan Feldbaum-Vidra on LinkedIn: Rating agency KBRA remains confident in US government top rating

US banks' liquidity crunch put underwater bond portfolios in focus