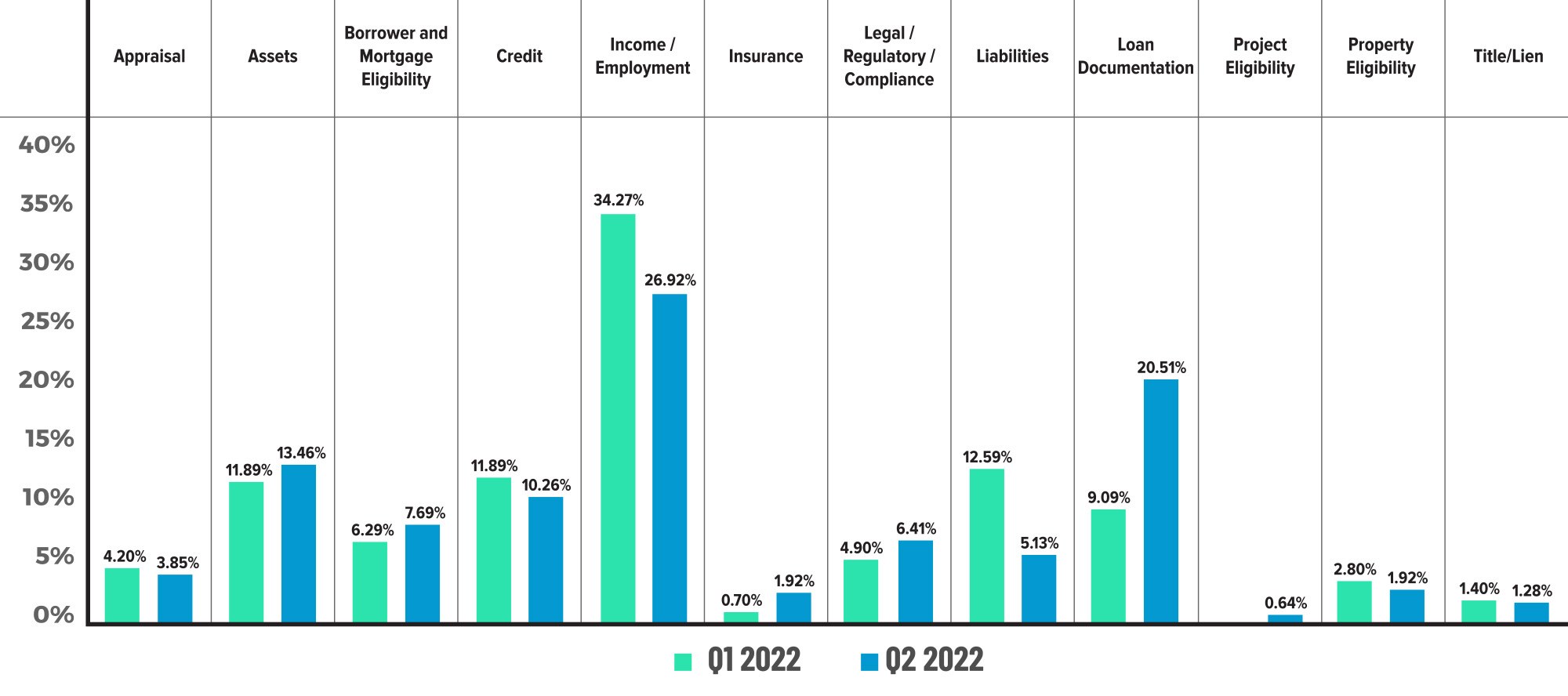

Critical defect rate of closed loans spiked in 2Q due to COVID-19

$ 8.00 · 4.9 (426) · In stock

Economic instability during the quarter drove the increase in findings regarding income and employment, Aces Quality Management reported.

Guidance for providing safe drinking water in areas of federal

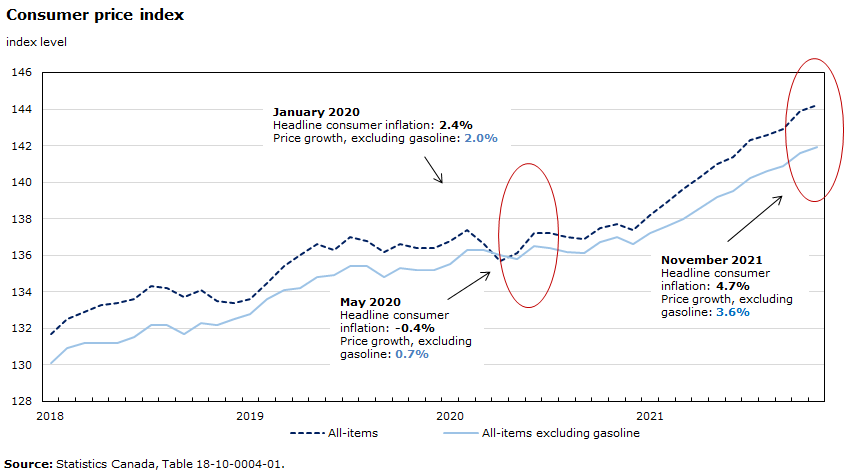

Bank of Canada is more worried than usual about debt loads

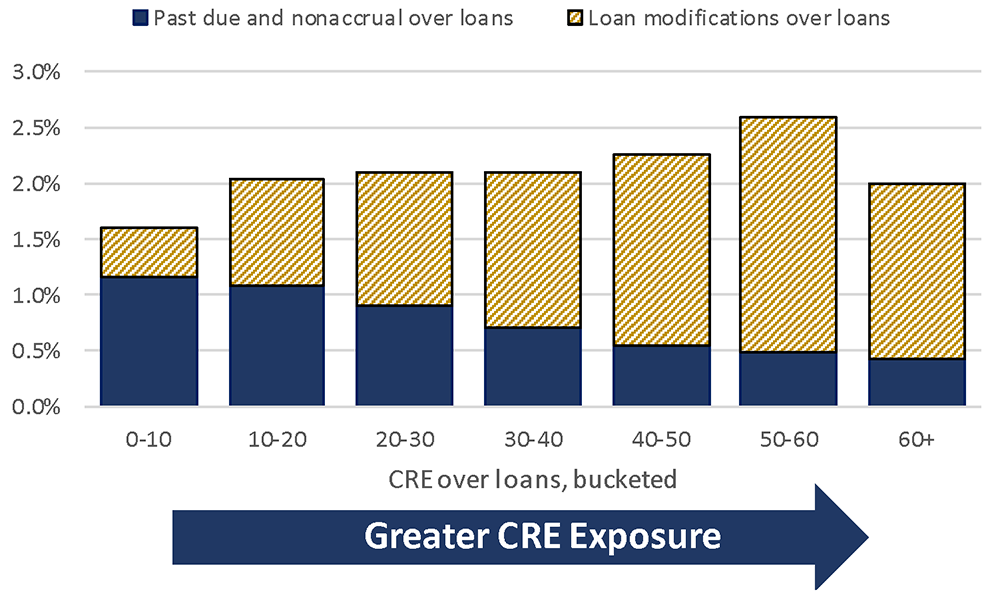

How COVID-19 Is Affecting Bank Ratings: October 2020 Update

ACES Q2 2022 ACES Mortgage QC Industry Trends

Inflation: Canadian business insolvencies increase amid interest

The Fed - The Pandemic's Impact on Credit Risk: Averted or Delayed?

Experts: COVID-19 Newsroom - McGill University

PDF) Direct Cryo-ET observation of platelet deformation induced by

Trevor Gauthier's Instagram, Twitter & Facebook on IDCrawl

Have banks caught corona? Effects of COVID on lending in the U.S.

Comments on New York City's Fiscal Year 2022 Executive Budget

COVID-19 in Canada: Year-end Update on Social and Economic Impacts

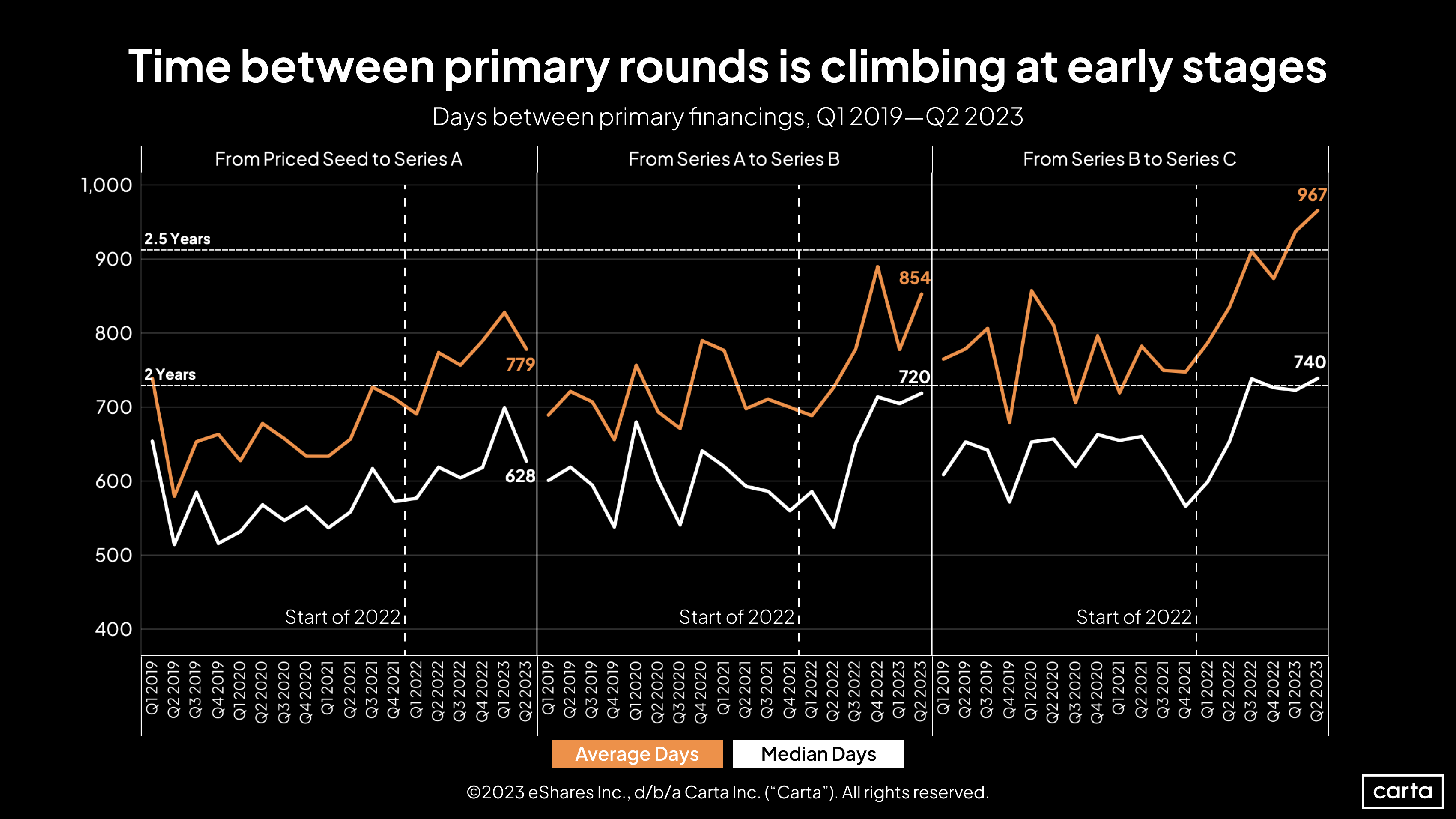

State of Private Markets: Q2 2023

MUSC Catalyst News, MUSC

Coronavirus outbreak: Live updates on COVID-19