When to sell your parents' home: The tax consequences - Ross Law

$ 13.99 · 5 (324) · In stock

Let’s say you’ve known for years that you are inheriting your father’s home when he dies. Hopefully, you also know that he has a will that indicates clearly that the house will go to you.

Michelle A. Ross - Leech Tishman: Legal Services

From simple roots, Mike Ross has emerged as business, civic leader, WV News

[Ross MD PhD, Theodora, Mukherjee, Siddhartha] on . *FREE* shipping on qualifying offers. A Cancer in the Family: Take Control of Your

A Cancer in the Family: Take Control of Your Genetic Inheritance

Crossover Day wrap: Flurry of bills passed at pivotal deadline • Georgia Recorder

What to Know Before Buying a Home With Your Parents - The New York Times

Understanding the Tax Consequences of Selling One's Personal Home: Part I

Too Big to Fail: The Inside Story of How Wall Street and Washington Fought to Save the Financial System-and Themselves: Sorkin, Andrew Ross: 9780143118244: : Books

Tax Consequences When Selling A House I Inherited in Massachusetts

Opinion The Rise of Single-Parent Families Is Not a Good Thing - The New York Times

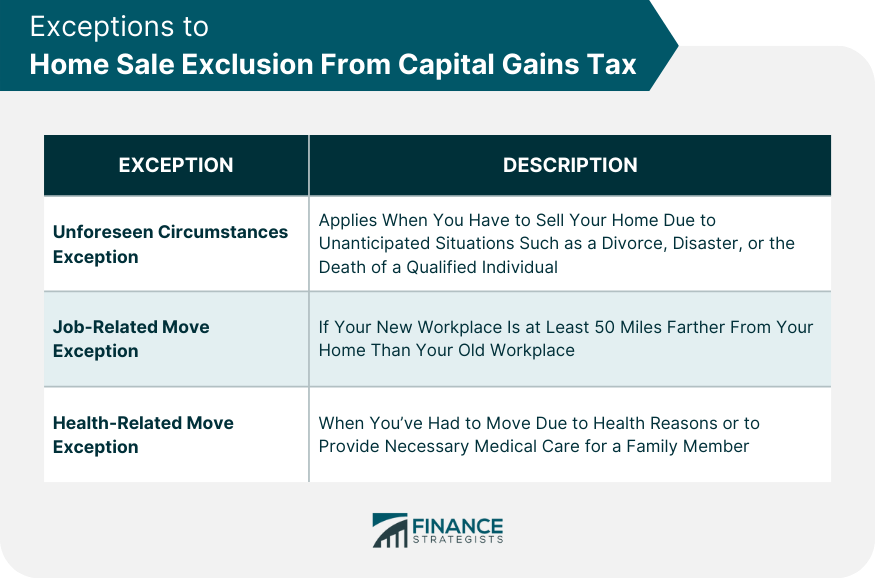

Home Sale Exclusion From Capital Gains Tax

Do as I Say, Not as I Do

Selling Your Parents' Estate — Lee Scott Perres, P.C.

Tax Consequences of Selling Your Home

Ross Stores lifts annual profit view on cooling freight, robust off-price demand

Selling Home to Family Member: Pros and Cons