What is the journal entry to record a foreign exchange transaction

$ 10.99 · 4.8 (104) · In stock

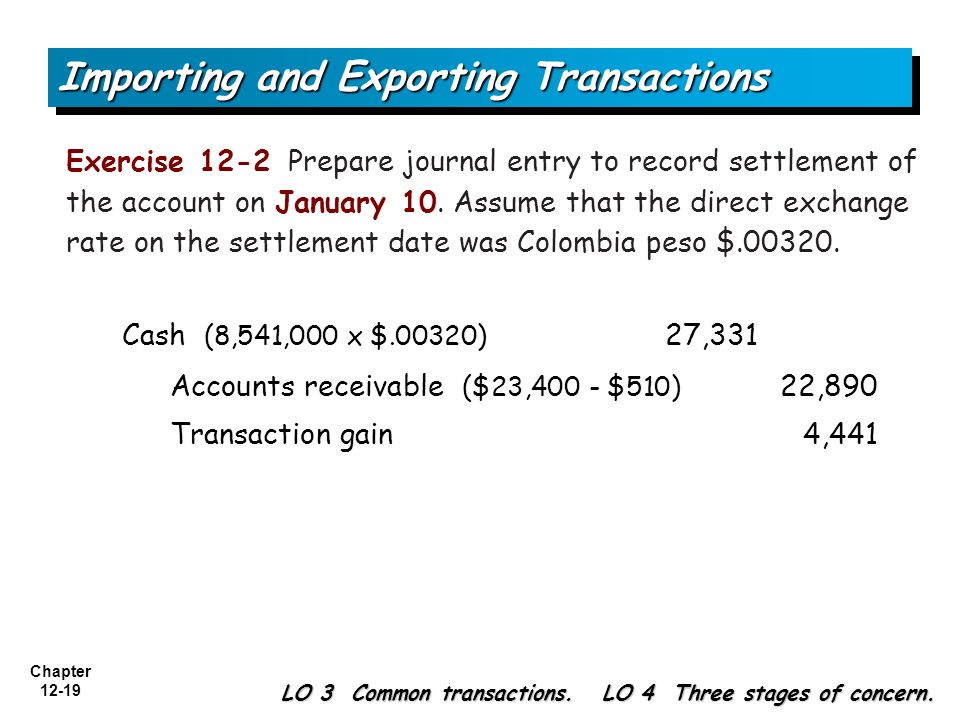

A foreign exchange transaction gain occurs when the transaction currency is different than the reporting currency for the company. On the initial transaction date, they would record the $100 sale with a debit to accounts receivable and a credit to revenue. However, 30 days later when the customer goes to pay using the current exchange

Cumulative Translation Adjustment (CTA): The Ultimate Guide

Hedges of Recognized Foreign Currency–Denominated Assets and Liabilities - The CPA Journal

Accounting for Bills of Exchange

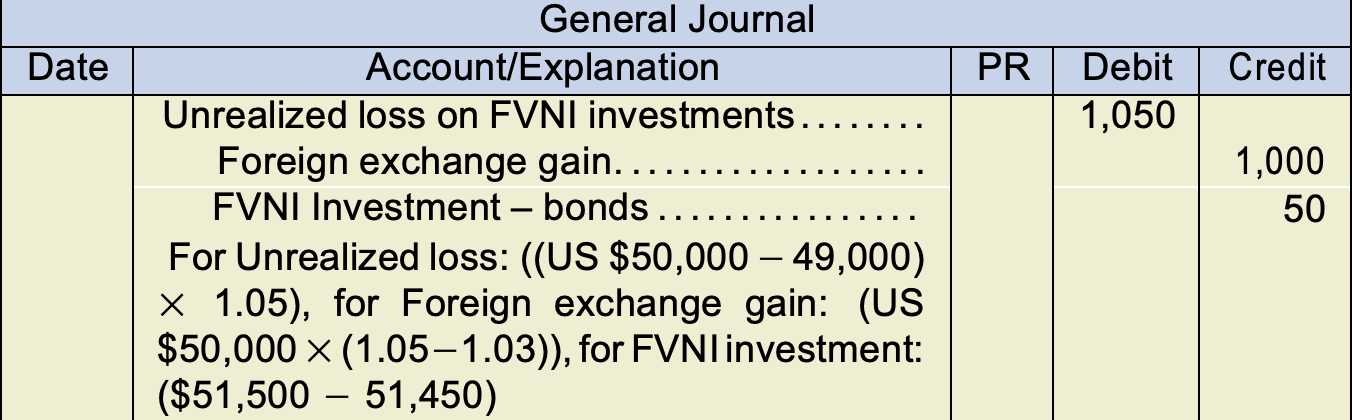

8.2 Non-Strategic Investments – Intermediate Financial Accounting 1

How do I record a US$ or other foreign currency transaction? — Young Associates

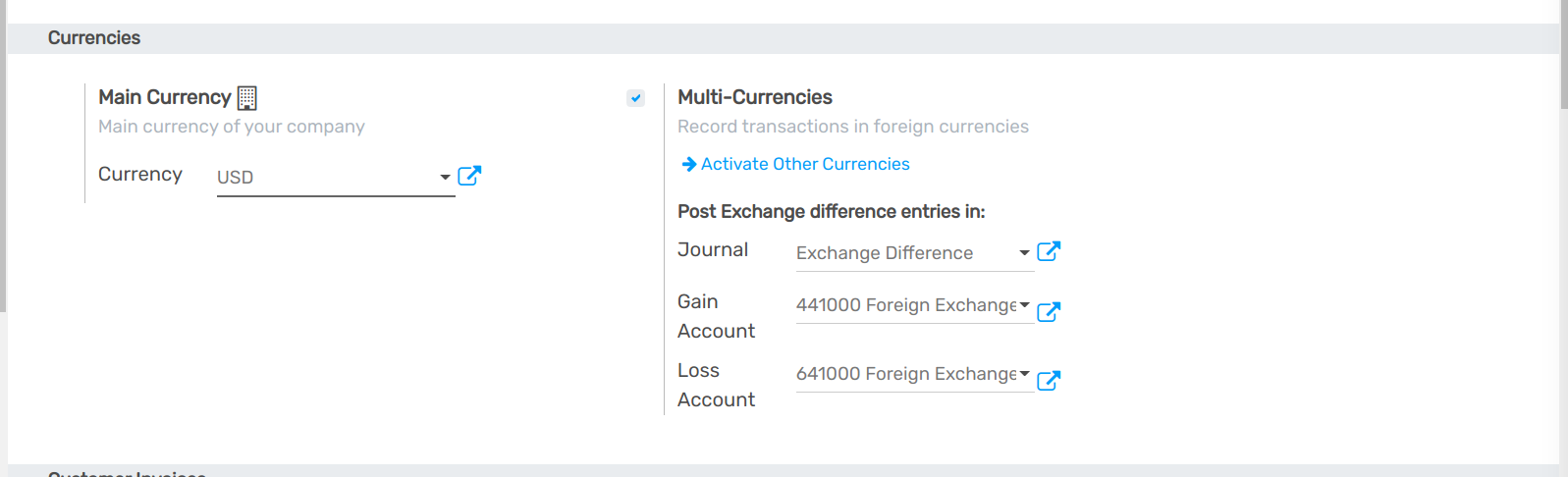

Record exchange rates at payments — Flectra 2.0 documentation

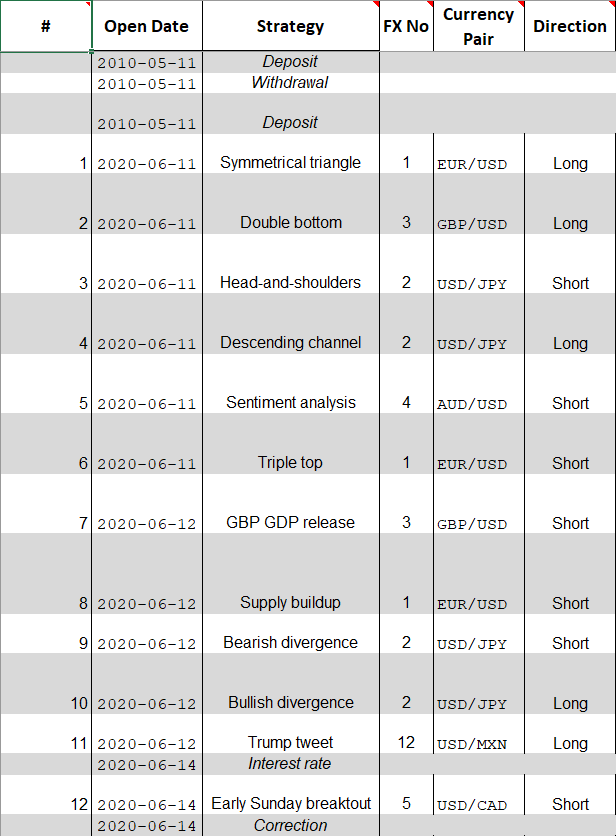

Forex Trading Log Book: FX Trade Journal and Logbook For Currency Trading. Foreign Exchange Notebook and Stock Market Investment Tracker for Investors to Record their Trades and their Strategies.: : Editions, Keep-a-Track

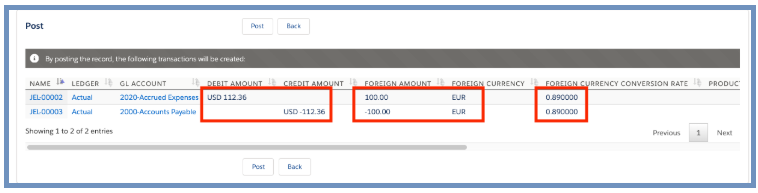

Example Multi-Currency Transactions – Accounting Seed Knowledge Base

Forex Trading Journal

Things to remember in Foreign Currency Valuation - SAP Community

SOLVED: Journal entries for an account receivable denominated in Euros (USD weakens). Assume that your company sells products to a customer located in France on October 15. The invoice specifies that payment

What types of journal entries are tested on the CPA exam? - Universal CPA Review

2 Accounting for Foreign Currency Transactions and Hedging Foreign Exchange Risk. - ppt video online download

Journal Entries in Accounting with Examples - GeeksforGeeks